Complex decision-making strategies in a stock market experiment explained as the combination of few simple strategies

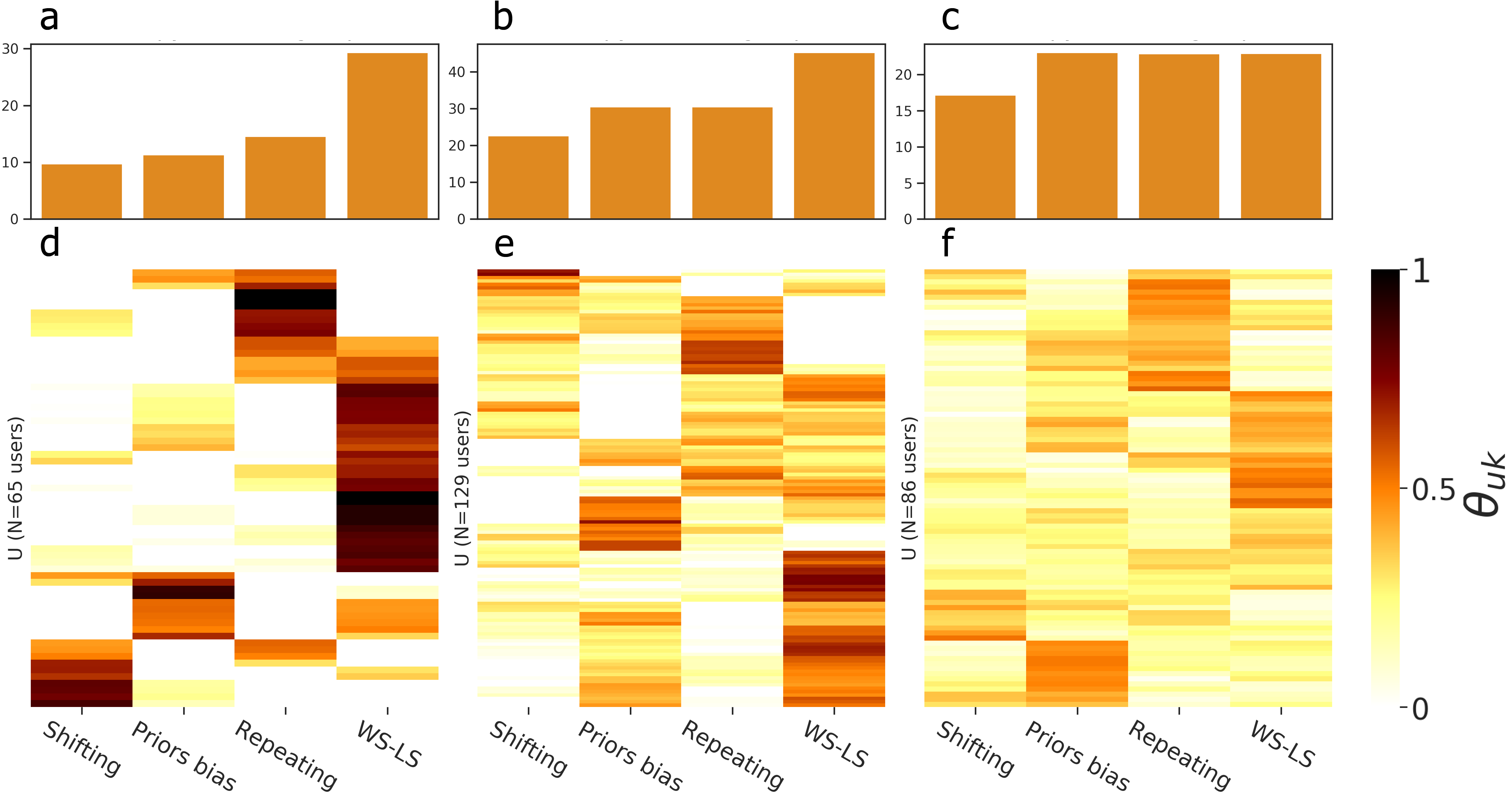

Many studies have shown that there are regularities in the way human beings make decisions. However, our ability to obtain models that capture such regularities and can accurately predict unobserved decisions is still limited. We tackle this problem in the context of individuals who are given information relative to the evolution of market prices and asked to guess the direction of the market. We use a networks inference approach with stochastic block models (SBM) to find the model and network representation that is most predictive of unobserved decisions. Our results suggest that users mostly use recent information (about the market and about their previous decisions) to guess. Furthermore, the analysis of SBM groups reveals a set of strategies used by players to process information and make decisions that is analogous to behaviors observed in other contexts. Our study provides and example on how to quantitatively explore human behavior strategies by representing decisions as networks and using rigorous inference and model-selection approaches.

Reference:

Complex decision-making strategies in a stock market experiment explained as the combination of few simple strategies

G. Poux-Médard, Sergio Cobo-Lopez, Jordi Duch, Roger Guimerà, Marta Sales-Pardo, EPJ Data Science (10), 2021